Calculate:

Choose your financial challenge:

Related Pages

Printable Math Worksheets

Online Math Quizzes

Math Games

Math Worksheets

This Compound Interest Calculator Quiz and Game is a great way to put your skills to the test in a fun environment. You need to use the Compound Interest Formula to find the Future Value, Interest, Principal or Rule of 72.

Compound Interest Game

This game focuses on the power of compounding. It covers four distinct skills:

Find Future Value (A): Using \(A = P(1+r)^t\).

Find Interest (I): The difference between the Future Value and Principal (A - P).

Find Principal (P): Working backward from a target amount.

Rule of 72: A quick estimate to estimate how long it takes for money to double.

Scroll down the page for a more detailed explanation.

Calculate:

Choose your financial challenge:

Your money is growing fast!

Final Score

0/0

How to Play the Compound Interest Game

Here’s how to play:

Compound Interest Formula

Compound interest is the interest calculated on the initial principal and also on all the accumulated interest from previous periods on a deposit or loan. This process, known as “compounding,” leads to exponential growth.

The Formula

The compound interest formula calculates the Future Value of the investment or loan, not just the interest earned.

\(A = P \left(1 + \frac{R}{n}\right)^{nt}\)

Where:

A is the Future Value / Total Amount (The final balance after t years)

P is the Principal (The initial amount deposited or borrowed)

R is the Rate (The annual interest rate expressed as a decimal, e.g., 6% = 0.06).

t is the Time (The total duration of the investment or loan)

n is the Compounding Frequency (The number of times interest is compounded per year)

How to Use the Formula (Step-by-Step)

Step 1: Ensure Rate (R) and Time (t) are Correctly Formatted

Rate (R): Convert the percentage rate to a decimal (e.g., 5% → 0.05).

Time (t): Ensure the duration is expressed in years (e.g., 18 months → 1.5 years).

Compounding Frequency (n): Identify the correct value for n.

Step 2: Calculate the Factor Inside the Parentheses

First, calculate the interest rate per compounding period (\(\frac{R}{n}\)), then add 1. This represents the growth factor for a single period.

\(\left(1 + \frac{R}{n}\right)\)

Step 3: Calculate the Total Number of Periods

Calculate the exponent (nt), which is the total number of compounding periods over the entire duration of the loan or investment.

Step 4: Calculate the Growth Multiplier

Raise the result from Step 2 to the power of the result from Step 3. This is the total factor by which the principal will grow.

\(\left(1 + \frac{R}{n}\right)^{nt}\)

Step 5: Calculate the Future Value (A)

Multiply the initial Principal (P) by the growth multiplier from Step 4.

\(A = P \times \left(\text{Growth Multiplier}\right)\)

Example Calculation

You invest $1,000 at an annual interest rate of 6%, compounded quarterly, for 5 years. What will the total amount be after 5 years?

Given values:

P = $1,000

R = 6% = 0.06 (Decimal Rate)

t = 5 years

n = 4 (Quarterly compounding)

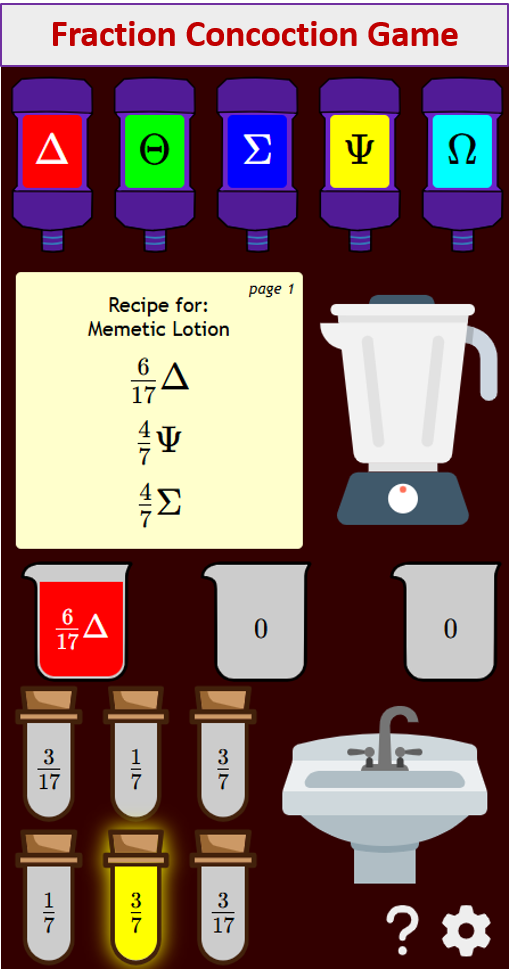

Try out our new and fun Fraction Concoction Game.

Add and subtract fractions to make exciting fraction concoctions following a recipe. There are four levels of difficulty: Easy, medium, hard and insane. Practice the basics of fraction addition and subtraction or challenge yourself with the insane level.

We welcome your feedback, comments and questions about this site or page. Please submit your feedback or enquiries via our Feedback page.