Percent Problems involving Taxes

Related Topics:

More Lessons for Grade 8

Math Worksheets

Videos, worksheets, stories and songs to help Grade 8 students learn how to solve percent problems involving taxes.

What is Sales Tax?

Sales tax is a consumption tax imposed by governments (state, county, or city) on the sale of goods and services. It is paid by the buyer at the point of purchase and collected by the seller, who then remits it to the government.

What is the Formula for Sales Tax?

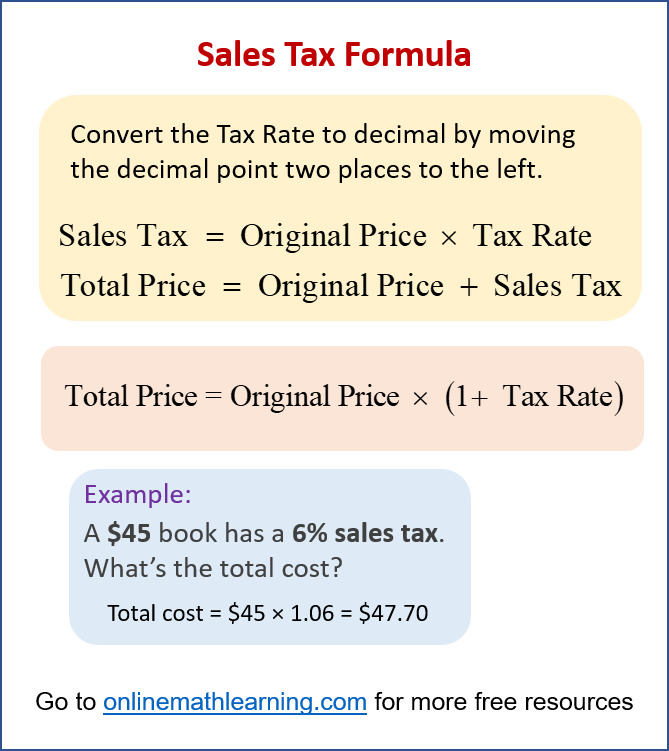

The following diagram shows how to calculate the sales tax using the sales tax formula. Scroll down the page for more examples and solutions.

Percent Worksheets

Practice your skills with the following percent worksheets:

Online & Printable Percent Worksheets

Steps to calculate the total price or total cost:

- Convert the Tax Rate to decimal by moving the decimal point two places to the left.

- Calculate the Sales Tax

Sales Tax = Original Price × Tax Rate (in decimal) - Calculate the total price

Total Price = Original Price + Sale Tax

It is also possible to combine steps 2 and 3 into one step.

Total Price = Original Price × (1 + Tax Rate)

Example:

A pair of shoes costs $120. With a sales tax of 8%, what is the total amount you will pay?

Solution:

Sales Tax Rate = 8% = 0.08

Original Price = $120

Total Cost = Original Price × (1 + Sales Tax Rate)

Total Cost = $120 × (1 + 0.08) = $120 × 1.08 = $129.60

Find Original Price/Pre-Tax Price

If you need to find the Original Price given the Tax Rate and the Total Price:

Original Price = \( \frac{Total Price}{1 + Tax Rate} \)

Example: You paid a total of $53.00 for a book, which included the 6% sales tax. What was the original price of the book before tax?

Solution:

Total Price (with tax) = $53.00

Sales Tax Rate = 6% = 0.06

Original Price = \( \frac{$53}{1.06} \) = $50.00)

The original price of the book was $50.00.

Find the Tax Rate

If you need to find the Tax Rate given the Original Price and the Total Price:

- Tax amount = Total Price - Original Price

- Tax Rate = \( \frac{Tax Amount}{Original Price} \) × 100%

Calculating Sales Tax

This video shows how to calculate sales tax using the two-step method or one-step method.

How to Calculate Sales Tax?

This video will show you how to calculate sales tax.

Find the Price after Tax, price before tax, and GST amount

This video shows how to find the price before the tax and the GST amount.

Find the Tax Rate

This video shows how to find the Tax Rate given the Total Price and the original price.

Example:

If after tax you pay $56.42 for an item that has a sale price of $52.00, what is the sales tax percentage?

Try out our new and fun Fraction Concoction Game.

Add and subtract fractions to make exciting fraction concoctions following a recipe. There are four levels of difficulty: Easy, medium, hard and insane. Practice the basics of fraction addition and subtraction or challenge yourself with the insane level.

We welcome your feedback, comments and questions about this site or page. Please submit your feedback or enquiries via our Feedback page.