Federal Income Tax

Related Topics:

Lesson Plans and Worksheets for Algebra I

Lesson Plans and Worksheets for all Grades

More Lessons for Algebra I

Common Core For Algebra I

Examples, videos, and solutions to help Algebra I students learn how to solve problems involving equations and inequalities.

New York State Common Core Math Algebra I, Module 1, Lesson 28

Worksheets for Algebra I, Module 1, Lesson 28 (pdf)

Student Outcomes

- Students create equations and inequalities in one variable and use them to solve problems.

- Students create equations in two or more variables to represent relationships between quantities and graph equations on coordinate axes with labels and scales.

- Students represent constraints by inequalities and interpret solutions as viable or non-viable options in a modeling context.

Exit Ticket

A famous movie actress made $10 million last year. She is married, has no children, and her husband does not earn any income. Assume that she computes her taxable income using the following formula:

(taxable income) = (income) – (exemptions) – (standard deductions)

Find her taxable income, her federal income tax, and her effective federal income tax rate.

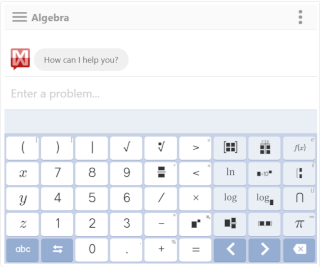

Try the free Mathway calculator and

problem solver below to practice various math topics. Try the given examples, or type in your own

problem and check your answer with the step-by-step explanations.

We welcome your feedback, comments and questions about this site or page. Please submit your feedback or enquiries via our Feedback page.